Launching a Successful Startup in Canada in 2024

May 14, 2024

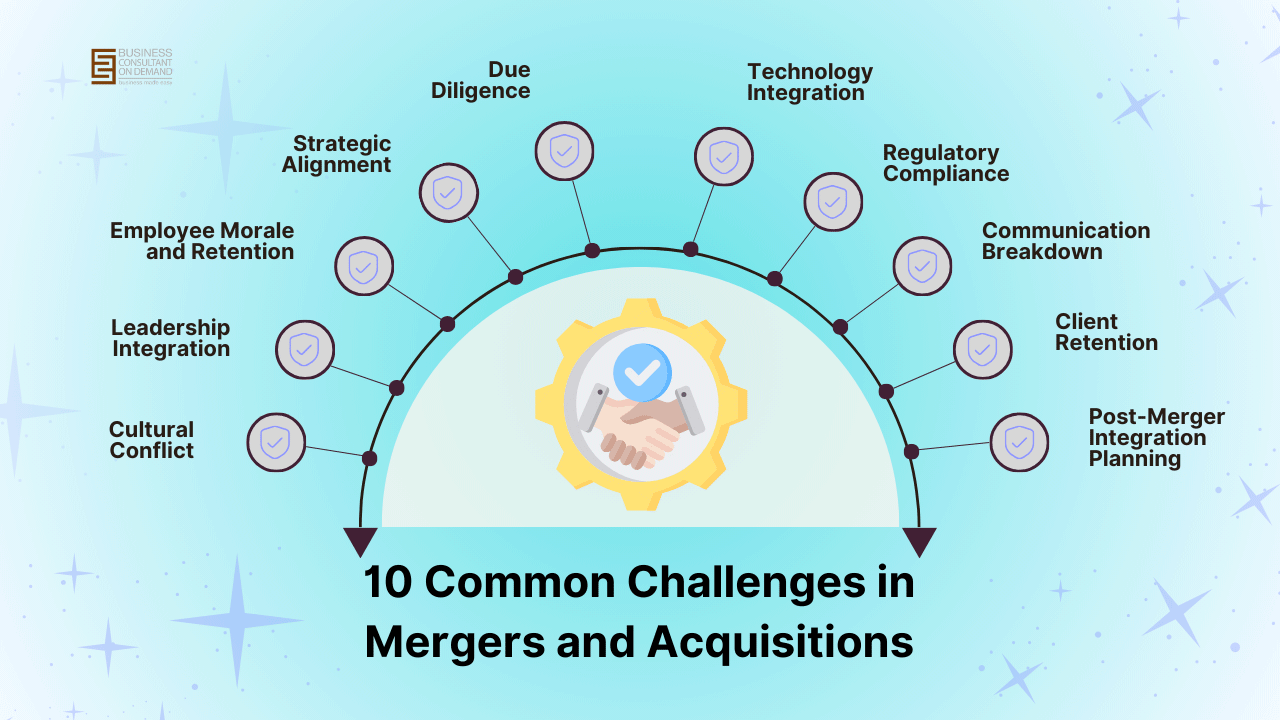

Mergers and acquisitions (M&A) have become integral strategies for businesses aiming to expand, diversify, or gain a competitive edge in the market. However, the road to a successful merger or acquisition is often fraught with challenges that demand careful consideration and strategic planning. In this blog, you will gain insight into common challenges in mergers and acquisitions and how you can overcome them.

Integrating two distinct organizational cultures is a pervasive challenge in M&A. Overcome this hurdle by prioritizing cultural alignment, fostering open communication, and creating a unified vision and values that resonate with employees from both entities. A harmonious work culture is key to a successful transition.

The consolidation of leadership teams from different organizations can lead to power struggles and uncertainty. Facilitate a smooth leadership transition by defining clear roles and responsibilities, acknowledging the strengths of each team, and promoting collaboration. A unified leadership approach will instill confidence among employees and stakeholders.

Concerns about job security and changes in the work environment can affect employee morale. Mitigate these concerns by maintaining transparent communication, addressing employee queries, and implementing retention programs. Involving employees in the transition process can foster a sense of ownership and commitment.

Ensuring that the strategic goals of both entities align is essential for the success of M&A. Conduct a thorough analysis of the strategic motivations behind the merger or acquisition and develop a clear roadmap for integration. Aligning objectives from the outset will facilitate a cohesive and purposeful transition.

Inadequate due diligence can lead to unforeseen risks and challenges. Expand the due diligence process beyond financial aspects to include legal, operational, and cultural considerations. A comprehensive analysis will provide a holistic view of potential opportunities and pitfalls, allowing for informed decision-making.

Aligning different technological infrastructures is a common challenge in M&A. Develop a detailed plan for integrating technologies, ensuring compatibility, and minimizing disruptions. A seamless transition in technology will support business processes and contribute to overall operational efficiency.

Navigating the complex landscape of legal and regulatory requirements is critical. Engage legal experts with expertise in M&A to ensure compliance with local and international regulations. Anticipate potential legal challenges, such as tax implications and industry-specific regulations, to mitigate risks effectively.

Effective communication is paramount throughout the M&A process. Establish clear communication channels, provide regular updates, and address concerns promptly. Transparent communication builds trust among employees, stakeholders, and customers, creating a positive atmosphere during the transition.

Maintaining client relationships is often overlooked in the midst of M&A. Prioritize client retention by ensuring a seamless customer experience. Communicate changes transparently, address concerns promptly, and emphasize the continued commitment to delivering high-quality products or services.

The post-merger integration phase is critical for long-term success. Develop a comprehensive and flexible integration plan that addresses both anticipated and unforeseen challenges. Prioritize continuity in business processes, employee engagement, and customer satisfaction to lay the foundation for a thriving future.

How can companies overcome cultural differences during an M&A?

Cultural integration requires proactive efforts such as open communication, cultural sensitivity training, and creating a shared vision and values that resonate with employees from both entities.

What role do legal experts play in the M&A process?

Legal experts specializing in M&A provide invaluable guidance in navigating complex legal and regulatory landscapes, ensuring compliance, and mitigating the legal risks associated with the transaction.

How can data room providers contribute to a successful M&A?

Data room providers play a crucial role in securely managing and sharing confidential information during the due diligence process. Choosing the right provider ensures data security, accessibility, and efficient collaboration between the involved parties.

What are some common pitfalls to avoid during post-merger integration?

Common pitfalls include neglecting cultural integration, underestimating the importance of client relationships, and not having a well-defined and flexible integration plan that addresses unforeseen challenges.

The world of mergers and acquisitions is obviously difficult, with numerous barriers to overcome. This blog has clarified the typical difficulties encountered in M&A deals and offered helpful advice on how to get beyond them. This guide provides a comprehensive overview of the entire process, from comprehending the complex world of strategic objectives to overcoming legal and regulatory challenges, and from emphasizing cultural integration to guaranteeing a smooth post-merger phase.

As companies embark on their M&A journey, it is critical to know that success extends beyond monetary considerations. In order to shape the outcome, human interaction, good communication, and thorough due diligence are essential. The significance of choosing the correct data room provider, consulting with legal experts, and developing a well-thought-out integration strategy cannot be understated.

We advise you to use a comprehensive approach that takes into account both quantitative and qualitative variables as you negotiate the complex world of mergers and acquisitions. Thorough preparation, strategic vision, and a profound comprehension of the various obstacles involved are essential. Start putting these insights into practice right now to get started on the path to a successful M&A transaction.

Start now to move toward a prosperous future—this is where your in-depth guide to mergers and acquisitions success starts. Take advantage of the chance to improve your tactics and increase the likelihood of long-term success. In the ever-changing world of mergers and acquisitions, rise to the occasion, get past the difficulties, and create the foundation for a successful future. Make it happen—your success story is waiting!

Related Topic

Fueling Business Growth and Sustainability through Merger and Acquisition Services

Comments